Rich Dad Poor Dad - My Perspective

Robert Kiyosaki, Sharon Lechter

A commentary on the book which I read "Rich Dad Poor Dad by Robert Kiyosaki & Sharon Lechter.

Notes I copied from the book.

I had two influential fathers, I learned from both of them. I had to think about each dad's advice, and in doing so, I gained valuable insight into the power and effect of one's thoughts on one's life. For example, one dad had a habit of saying, “I can't afford it.” The other dad forbade those words to be used. He insisted I say, “How can I afford it?” One is a statement, and the other is a question. One lets you off the hook, and the other forces you to think. My soon-to-be-rich dad would explain that by automatically saying the words “I can't afford it,” your brain stops working. By asking the question “How can I afford it?” your brain is put to work. He did not mean to buy everything you wanted. He was fanatical about exercising your mind, the most powerful computer in the world. “My brain gets stronger every day because I exercise it. The stronger it gets, the more money I can make.” He believed that automatically saying “I can't afford it” was a sign of mental laziness

I had two influential fathers, I learned from both of them. I had to think about each dad's advice, and in doing so, I gained valuable insight into the power and effect of one's thoughts on one's life. For example, one dad had a habit of saying, “I can't afford it.” The other dad forbade those words to be used. He insisted I say, “How can I afford it?” One is a statement, and the other is a question. One lets you off the hook, and the other forces you to think. My soon-to-be-rich dad would explain that by automatically saying the words “I can't afford it,” your brain stops working. By asking the question “How can I afford it?” your brain is put to work. He did not mean to buy everything you wanted. He was fanatical about exercising your mind, the most powerful computer in the world. “My brain gets stronger every day because I exercise it. The stronger it gets, the more money I can make.” He believed that automatically saying “I can't afford it” was a sign of mental laziness

It is not much different from a person who goes to the gym to exercise on a regular basis versus someone who sits on the couch watching television. Proper physical exercise increases your chances for health, and proper mental exercise increases your chances for wealth. Laziness decreases both health and wealth.

One dad taught me how to write an impressive resume so I could find a good job. The other taught me how to write strong business and financial plans so I could create jobs.

For example, my poor dad always said, “I'll never be rich.” And that prophesy became reality. My rich dad, on the other hand, always referred to himself as rich. He would say things like, “I'm a rich man, and rich people don't do this.” Even when he was flat broke after a major financial setback, he continued to refer to himself as a rich man. He would cover himself by saying, “There is a difference between being poor and being broke. - Broke is temporary, and the poor is eternal.”

My poor dad would also say, “I'm not interested in money,” or “Money doesn't matter.” My rich dad always said, “Money is power.”

The other encouraged me to study to be rich, to understand how money works and to learn how to have it work for me. “I don't work for money!” were words he would repeat over and over, “Money works for me!”

Money is one form of power. But what is more powerful is financial education. Money comes and goes, but if you have the education about how money works, you gain power over it and can begin building wealth. The reason positive thinking alone does not work is that most people went to school and never learned how money works, so they spend their lives working for money.

This book is about those six lessons, put as simply as possible as my rich dad put forth those lessons to me. The lessons are not meant to be answers but guideposts. Guideposts that will assist you and your children to grow wealthier no matter what happens in a world of increasing change and uncertainty

- Lesson #1 The Rich Don't Work for Money

- Lesson #2 Why Teach Financial Literacy?

- Lesson #3 Mind Your own Business

- Lesson #4 The History of Taxes and the Power of Corporations

- Lesson #5 The Rich Invent Money

- Lesson #6 Work to Learn Don't Work for Money

Robert Kiyosaki, Sharon Lechter

A commentary on the book which I read "Rich Dad Poor Dad by Robert Kiyosaki & Sharon Lechter.

Notes I copied from the book.

I had two influential fathers, I learned from both of them. I had to think about each dad's advice, and in doing so, I gained valuable insight into the power and effect of one's thoughts on one's life. For example, one dad had a habit of saying, “I can't afford it.” The other dad forbade those words to be used. He insisted I say, “How can I afford it?” One is a statement, and the other is a question. One lets you off the hook, and the other forces you to think. My soon-to-be-rich dad would explain that by automatically saying the words “I can't afford it,” your brain stops working. By asking the question “How can I afford it?” your brain is put to work. He did not mean to buy everything you wanted. He was fanatical about exercising your mind, the most powerful computer in the world. “My brain gets stronger every day because I exercise it. The stronger it gets, the more money I can make.” He believed that automatically saying “I can't afford it” was a sign of mental laziness

I had two influential fathers, I learned from both of them. I had to think about each dad's advice, and in doing so, I gained valuable insight into the power and effect of one's thoughts on one's life. For example, one dad had a habit of saying, “I can't afford it.” The other dad forbade those words to be used. He insisted I say, “How can I afford it?” One is a statement, and the other is a question. One lets you off the hook, and the other forces you to think. My soon-to-be-rich dad would explain that by automatically saying the words “I can't afford it,” your brain stops working. By asking the question “How can I afford it?” your brain is put to work. He did not mean to buy everything you wanted. He was fanatical about exercising your mind, the most powerful computer in the world. “My brain gets stronger every day because I exercise it. The stronger it gets, the more money I can make.” He believed that automatically saying “I can't afford it” was a sign of mental lazinessMy poor dad would also say, “I'm not interested in money,” or “Money doesn't matter.” My rich dad always said, “Money is power.”

- Lesson #1 The Rich Don't Work for Money

- Lesson #2 Why Teach Financial Literacy?

- Lesson #3 Mind Your own Business

- Lesson #4 The History of Taxes and the Power of Corporations

- Lesson #5 The Rich Invent Money

- Lesson #6 Work to Learn Don't Work for Money

Lesson #1 The Rich Don't Work for Money

My father was just leaving as I said that. “Boys,” he said. "You're only poor if you give up. The most important thing is that you did something. Most people only talk and dream of getting rich. You've done something. I'm very proud of the two of you. I will say it again Keep going. Don't quit."

My father was just leaving as I said that. “Boys,” he said. "You're only poor if you give up. The most important thing is that you did something. Most people only talk and dream of getting rich. You've done something. I'm very proud of the two of you. I will say it again Keep going. Don't quit."

“Ready boys?” Mike's dad asked as he pulled up a chair to sit down with us

“Mike says you want to learn to make money? Is that correct, Robert?”

“OK, here's my offer. I'll teach you, but I won't do it classroom-style. You work for me, I'll teach you. You don't work for me, I won't teach you. I can teach you faster if you work, and I'm wasting my time if you just want to sit and listen, like you do in school. That's my offer. Take it or leave it.” “Ah... may I ask a question first?” I asked. “No. Take it or leave it. I've got too much work to do to waste my time. If you can't make up you mind decisively, then you'll never learn to make money anyway. Opportunities come and go. Being able to know when to make quick decisions is an important skill. You have an opportunity that you asked for. School is beginning or it's over in ten seconds,” Mike's dad said with a teasing smile.

“Take it,” I said. `

“Take it,” said Mike.

“So what do you have to say?” I demanded, feeling pretty brave for a little kid. “You lied to me. I've worked for you, and you have not kept your word. You haven't taught me anything.”

“How do you know that I've not taught you anything?” asked rich dad calmly.

“Well, you've never talked to me. I've worked for three weeks, and you have not taught me anything,” I said with a pout.

“Does teaching mean talking or a lecture?” rich dad asked.

“Well, yes,” I replied.

“That's how they teach you in school,” he said smiling. “But that is not how life teaches you, and I would say that life is the best teacher of all. Most of the time, life does not talk to you. It just sorts of pushes you around. Each push is life saying, `Wake up. There's something I want you to learn.'

“If you learn life's lessons, you will do well. If not, life will just continue to push you around. People do two things. Some just let life push them around. Others get angry and push back. But they push back against their boss, or their job, or their husband or wife. They do not know it's the life that's pushing.”

“Life pushes all of us around. Some give up. Others fight. A few learn the lesson and move on. They welcome life pushing them around. To these few people, it means they need and want to learn something. They learn and move on. Most quit, and a few like you fight.”

“If you learn this lesson, you will grow into a wise, wealthy, and happy young man. If you don't, you will spend your life blaming a job, low pay, or your boss for your problems. You'll live life hoping for that big break that will solve all your money problems.”

Rich dad stood and shut the creaky old wooden window that needed repair. “If you learn this lesson, you will grow into a wise, wealthy, and happy young man. If you don't, you will spend your life blaming a job, low pay, or your boss for your problems. You'll live life hoping for that big break that will solve all your money problems.”

Rich dad continued. “Or if you're the kind of person who has no guts, you just give up every time life pushes you. If you're that kind of person, you'll live all your life playing it safe, doing the right things, saving yourself for some event that never happens. Then, you die a boring old man. You'll have lots of friends who really like you because you were such a nice hard-working guy. You spent a life playing it safe, doing the right things. But the truth is, you let life push you into submission. Deep down you were terrified of taking risks. You really wanted to win, but the fear of losing was greater than the excitement of winning. Deep inside, you and only you will know you didn't go for it. You chose to play it safe.”

“You boys are the first people that have ever asked me to teach them how to make money. I have more than 150 employees, and not one of them has asked me what I know about money. They ask me for a job and a paycheck, but never to teach them about money. So most will spend the best years of their lives working for money, not really understanding what it is they are working for.”

“So what is the lesson I learned from working for only 10 cents an hour?” I asked. “That you're cheap and exploit your workers?”

Rich dad rocked back and laughed heartily. Finally, after his laughing stopped, he said, “You'd best change your point of view. Stop blaming me, thinking I'm the problem. If you think I'm the problem, then you have to change me. If you realize that you're the problem, then you can change yourself, learn something and grow wiser. Most people want everyone else in the world to change but themselves. Let me tell you, it's easier to change yourself than everyone else.”

"Well, keep that attitude and you learn nothing. Keep the attitude that I'm the problem and what choices do you have?"

“Well, if you don't pay me more or show me more respect and teach me, I'll quit.”

“Well put,” rich dad said. “And that's exactly what most people do. They quit and go looking for another job, better opportunity, and higher pay, actually thinking that a new job or more pay will solve the problem. In most cases, it won't.”

“So what will solve the problem?” I asked. “Just take this measly 10 cents an hour and smile?”

Rich dad smiled. “That's what the other people do. Just accept a paycheck knowing that they and their family will struggle financially. But that's all they do, waiting for a raise thinking that more money will solve the problem. Most just accept it, and some take a second job working harder, but again accepting a small paycheck.”

I sat staring at the floor, beginning to understand the lesson rich dad was presenting. I could sense it was a taste of life. Finally, I looked up and repeated the question. “So what will solve the problem?”

“This,” he said tapping me gently on the head. “This stuff between your ears.”

“The poor and the middle-class work for money.” “The rich have money work for them.”

My rich dad continued my first lesson, “I'm glad you got angry about working for 10 cents an hour. If you had not gotten angry and had gladly accepted it, I would have to tell you that I could not teach you. You see, true learning takes energy, passion, a burning desire. Anger is a big part of that formula, for passion is anger and love combined. When it comes to money, most people want to play it safe and feel secure. So passion does not direct them: Fear does.”

My rich dad continued my first lesson, “I'm glad you got angry about working for 10 cents an hour. If you had not gotten angry and had gladly accepted it, I would have to tell you that I could not teach you. You see, true learning takes energy, passion, a burning desire. Anger is a big part of that formula, for passion is anger and love combined. When it comes to money, most people want to play it safe and feel secure. So passion does not direct them: Fear does.”

“You see, your dad went to school and got an excellent education, so he could get a high-paying job. Which he did. But he still has money problems because he never learned anything about money at school. On top of that, he believes in working for money.”

“If you want to learn to work for money, then stay in school. That is a great place to learn to do that. But if you want to learn how to have money work for you, then I will teach you that. But only if you want to learn.”

"Don't worry about that for now. Just know that it's fear that keeps most people working at a job. The fear of not paying their bills. The fear of being fired. The fear of not having enough money. The fear of starting over. That's the price of studying to learn a profession or trade, and then working for money. Most people become a slave to money... and then get angry at their boss."

“As I said, there is a lot to learn. Learning how to have money work for you is a lifetime study. Most people go to college for four years, and their education ends. I already know that my study of money will continue over my lifetime, simply because the more I find out, the more I find out I need to know. Most people never study the subject. They go to work, get their paycheck, balance their checkbooks, and that's it. On top of that, they wonder why they have money problems. Then, they think that more money will solve the problem. Few realize that it's their lack of financial education that is the problem.”

rich dad said softly. “Most people have a price. And they have a price because of human emotions named fear and greed. First, the fear of being without money motivates us to work hard, and then once we get that paycheck, greed or desire starts us thinking about all the wonderful things money can buy. The pattern is then set.”

“What pattern?” I asked.

“The pattern of get up, go to work, pay bills, get up, go to work, pay bills... Their lives are then run forever by two emotions, fear and greed. Offer them more money, and they continue the cycle by also increasing their spending. This is what I call the Rat Race.”

"Instead of telling the truth about how they feel, they react to their feeling, fail to think. They feel the fear, they go to work, hoping that money will soothe the fear, but it doesn't. That old fear haunts them, and they go back to work, hoping again that money will calm their fears, and again it doesn't. Fear has them in this trap of working, earning money, working, earning money, hoping the fear will go away. But every day they get up, and that old fear wakes up with them. For millions of people, that old fear keeps them awake all night, causing a night of turmoil and worry. So they get up and go to work, hoping that a paycheck will kill that fear gnawing at their soul. Money is running their lives, and they refuse to tell the truth about that

Money is in control of their emotions and hence their souls."

Let me finish the other emotion, which is desire. Some call it greed, but I prefer desire. It is perfectly normal to desire something better, prettier, more fun, or exciting. So people also work for money because of desire. They desire money for the joy they think it can buy. But the joy that money brings is often short-lived, and they soon need more money for more joy, more pleasure, more comfort, more security. So they keep working, thinking money will soothe their souls that are troubled by fear and desire. But money cannot do that.”

“In fact, the reason many rich people are rich is not because of desire but because of fear. They actually think that money can eliminate that fear of not having money, of being poor, so they amass tons of it only to find out the fear gets worse. They now fear losing it

The avoidance of money is just as psychotic as being attached to money.”

“Emotions are what make us human. Make us real. The word `emotion' stands for energy in motion. Be truthful about your emotions, and use your mind and emotions in your favor, not against yourself.”

“You see, we're all employees ultimately. We just work at different levels,” said rich dad. “I just want you boys to have a chance to avoid the trap. The trap caused by those two emotions, fear, and desire. Use them in your favor, not against you. That's what I want to teach you. I'm not interested in just teaching you to make a pile of money. That won't handle the fear or desire. If you don't first handle fear and desire, and you get rich, you'll only be a high-paid slave.”

“The main cause of poverty or financial struggle is fear and ignorance, not the economy or the government or the rich. It's self-inflicted fear and ignorance that keeps people trapped

school never told him how to handle money or his fears

“By not giving in to your emotions, you were able to delay your reactions and think. That is the most important. We will always have emotions of fear and greed. From here on in, it is most important for you to use those emotions to your advantage and for the long term, and not simply let your emotions run you by controlling your thinking. Most people use fear and greed against themselves. That's the start of ignorance. Most people live their lives chasing paychecks, pay raises, and job security because of the emotions of desire and fear, not really questioning where those emotion-driven thoughts are leading them. It's just like the picture of a donkey, dragging a cart, with its owner dangling a carrot just in front of the donkey's nose. The donkey's owner may be going where he wants to go, but the donkey is chasing an illusion. Tomorrow there will only be another carrot for the donkey.

“Fear pushes you out the door, and desire calls to you. Enticing you toward the rocks. That's the trap.

What intensifies fear and desire is ignorance. That is why rich people with lots of money often have more fear of the richer they get. Money is the carrot, the illusion

school is very, very important. You go to school to learn a skill or profession so as to be a contributing member of society. Every culture needs teachers, doctors, mechanics, artists, cooks, business people, police officers, firefighters, soldiers. Schools train them so our culture can thrive and flourish,” said rich dad. “Unfortunately, for many people, school is the end, not the beginning.”

I want you always to think of the donkey. Never forget, because your two emotions, fear, and desire, can lead you into life's biggest trap if you're not aware of them controlling your thinking. To spend your life living in fear, never exploring your dreams, is cruel. To work hard for money, thinking that money will buy you things that will make you happy is also cruel. To wake up in the middle of the night terrified about paying bills is a horrible way to live. To live a life dictated by the size of a paycheck is not really a life. Thinking that a job will make you feel secure is lying to yourself. That's cruel, and that's the trap I want you to avoid, if possible. I've seen how money runs people's lives. Don't let that happen to you. Please don't let money run your life."

Great civilizations collapsed when the gap between the haves and have-nots was too great

Prices go up because of greed and fear caused by ignorance. If schools taught people about money, there would be more money and lower prices, but schools focus only on teaching people to work for money, not how to harness money's power.”

“Learn to use your emotions to think, not think with your emotions.

We had learned to have money work for us. By not getting paid for our work at the store, we were forced to use our imaginations to identify an opportunity to make money. By starting our own business, the comic-book library, we were in control of our own finances, not dependent on an employer. The best part was that our business generated money for us, even when we weren't physically there. Our money worked for us. Instead of paying us money, rich dad had given us so much more.

My father was just leaving as I said that. “Boys,” he said. "You're only poor if you give up. The most important thing is that you did something. Most people only talk and dream of getting rich. You've done something. I'm very proud of the two of you. I will say it again Keep going. Don't quit."

My father was just leaving as I said that. “Boys,” he said. "You're only poor if you give up. The most important thing is that you did something. Most people only talk and dream of getting rich. You've done something. I'm very proud of the two of you. I will say it again Keep going. Don't quit." My rich dad continued my first lesson, “I'm glad you got angry about working for 10 cents an hour. If you had not gotten angry and had gladly accepted it, I would have to tell you that I could not teach you. You see, true learning takes energy, passion, a burning desire. Anger is a big part of that formula, for passion is anger and love combined. When it comes to money, most people want to play it safe and feel secure. So passion does not direct them: Fear does.”

My rich dad continued my first lesson, “I'm glad you got angry about working for 10 cents an hour. If you had not gotten angry and had gladly accepted it, I would have to tell you that I could not teach you. You see, true learning takes energy, passion, a burning desire. Anger is a big part of that formula, for passion is anger and love combined. When it comes to money, most people want to play it safe and feel secure. So passion does not direct them: Fear does.” Lesson Two: Why Teach Financial Literacy?

“If you want to be rich, you need to be financially literate.”

accounting is possibly the most boring subject in the world. It also could be the most confusing. But if you want to be rich, long term, it could be the most important subject. The question is, how do you take a boring and confusing subject and teach it to kids? The answer is, make it simple. Teach it first in pictures.

Rule One. You must know the difference between an asset and a liability, and buy assets. If you want to be rich, this is all you need to know. It is Rule No. 1. It is the only rule.

KISS principle-“Keep It Simple Stupid”

“If you want to be rich, you've got to read and understand numbers.”

“assets put money in your pocket."

An asset is something that puts money in my pocket.

A liability is something that takes money out of my pocket.

If you want to be rich, simply spend your life buying assets. If you want to be poor or middle class, spend your life buying liabilities

Money only accentuates the cash flow pattern running in your head

If your pattern is to spend everything you get, most likely an increase in cash will just result in an increase in spending. Thus, the saying, “A fool and his money is one big party,”

More money seldom solves someone's money problems. Intelligence solves problems,

He uses to tell us over and over again. “An intelligent person hires people who are more intelligent than they are.”

the difference in perception between my rich dad and my poor dad when it came to their homes. One dad thought his house was an asset, and the other dad thought it was a liability

So here is the argument I put forth. I really do not expect most people to agree with it because a nice home is an emotional thing. And when it comes to money, high emotions tend to lower financial intelligence. 1 know from personal experience that money has a way of making every decision emotional.

1. When it comes to houses, I point out that most people work all their lives paying for a home they never own. In other words, most people buy a new house every so many year, each time incurring a new 30-year loan to pay off the previous one

2. Even though people receive a tax deduction for interest on mortgage payments, they pay for all their other expenses with after-tax dollars. Even after they pay off their mortgage.

3. Property taxes. My wife's parents were shocked when the property taxes on their home went to $1,000 a month. This was after they had retired, so the increase put a strain on their retirement budget, and they felt forced to move.

4 Houses do not always go up in value. In 1997, I still have friends who owe a million dollars for a home that will today sell for only $700,000.

5. The greatest losses of all are those from missed opportunities. If all your money is tied up in your house, you may be forced to work harder because your money continues blowing out of the expense column, instead of adding to the asset column, the classic middle-class cash flow pattern. If a young couple would put more money into their asset column early on, their later years would get easier, especially as they prepared to send their children to college. Their assets would have grown and would be available to help cover expenses. All too often, a house only serves as a vehicle for incurring a home-equity loan to pay for mounting expenses. In summary, the end results in making a decision to own a house that is too expensive in lieu of starting an investment portfolio early on impacts an individual in at least the following three ways:

1. Loss of time, during which other assets could have grown in value

2. Loss of additional capital, which could have been invested instead of paying for high-maintenance expenses related directly to the home.

3. Loss of education. Too often, people count their house, savings, and retirement plan as all they have in their asset column. Because they have no money to invest, they simply do not invest. This costs them investment experience. Most never become what the investment world calls a “sophisticated investor.” And the best investments are usually first sold to “sophisticated investors,” who then turn around and sell them to the people playing it safe. I am not saying don't buy a house. I am saying, understand the difference between an asset and a liability. When I want a bigger house, I first buy assets that will generate the cash flow to pay for the house

They treat their home as their primary asset, instead of on investing in income-producing assets.

Income = Work for Owner Expense = Work for Government Asset = (none) Liability = Work for Bank

As an employee who is also a homeowner, your working efforts are generally as follows:

1. You work for someone else. Most people, working for a paycheck, are making the owner, or the shareholders richer. Your efforts and success will help provide for the owner's success and retirement.

2. You work for the government. The government takes its share from your paycheck before you even see it. By working harder, you simply increase the amount of taxes taken by the government - most people work from January to May just for the government.

3. You work for the bank. After taxes, your next largest expense is usually your mortgage and credit card debt.

As their assets grow, how do they measure the extent of their success? When does someone realize that they are rich, that they have wealth? As well as having my own definitions for assets and liabilities, I also have my own definition of wealth. Actually, I borrowed it from a man named Buckminster Fuller. Some call him a quack, and others call him a living genius.

Wealth is the measure of the cash flow from the asset column compared with the expense column.

If I quit my job today, I would be able to cover my monthly expenses with the cash flow from my assets.

as long as I keep my expenses less than the cash flow from these assets, I will grow richer, with more and more income from sources other than my physical labor

remember this simple observation: The rich buy assets. The poor only have expenses. The middle class buys liabilities they think are assets.

Lesson Three: Mind Your Own Business

McDonald's today is the largest single owner of real estate in the world, owning even more than the Catholic Church. Today, McDonald's owns some of the most valuable intersections and street corners in America, as well as in other parts of the world.

McDonald's today is the largest single owner of real estate in the world, owning even more than the Catholic Church. Today, McDonald's owns some of the most valuable intersections and street corners in America, as well as in other parts of the world.

It is secret No. 3 of the rich.

The secret is: "Mind your own business/' Financial struggle is often directly the result of people working all their lives for someone else. Many people will have nothing at the end of their working days

There is a big difference between your profession and your business. Often I ask people, “What is your business?” And they will say, “Oh I'm a banker.” Then I ask them if they own the bank? And they usually respond. “No, I work there.” In that instance, they have confused their profession with their business. Their profession may be a banker, but they still need their own business.

To become financially secure, a person needs to mind their own business. Your business revolves around your asset column, as opposed to your income column. As stated earlier, the No. 1 rule is to know the difference between an asset and a liability and to buy assets. The rich focus on their asset columns while everyone else focuses on their income statements.

So what kind of assets am I suggesting that you or your children acquire? In my world, real assets fall into several different categories:

1. Businesses that do not require my presence. I own them, but they are managed or run by other people. If I have to work there, it's not a business. It becomes my job.

2. Stocks.

3. Bonds.

4. Mutual funds.

5. Income-generating real estate.

6. Notes (lOUs).

7. Royalties from intellectual property such as music, scripts, patents.

8. And anything else that has value, produces income or appreciates and has a ready market.

When I say mind your own business, 1 means to build and keep your asset column strong. Once a dollar goes into it, never let it come out. Think of it this way, once a dollar goes into your asset column, it becomes your employee. The best thing about money is that it works 24 hours a day and can work for generations. Keep your daytime job, be a great hard-working employee, but keep building that asset column.

True luxury is a reward for investing in and developing a real asset.

After you've taken the time and invested in and built your own business, you are now ready to add the magic touch-the the biggest secret of the rich. The secret that puts the rich way ahead of the pack. The reward at the end of the road for diligently taking the time to mind your own business.

McDonald's today is the largest single owner of real estate in the world, owning even more than the Catholic Church. Today, McDonald's owns some of the most valuable intersections and street corners in America, as well as in other parts of the world.

McDonald's today is the largest single owner of real estate in the world, owning even more than the Catholic Church. Today, McDonald's owns some of the most valuable intersections and street corners in America, as well as in other parts of the world.Lesson Four: The History of and The Power of Corporation

In 1874, England made income tax a permanent levy on its citizens. In 1913, an income tax became permanent in the United States with the adoption of the 16th Amendment to the Constitution.

In 1874, England made income tax a permanent levy on its citizens. In 1913, an income tax became permanent in the United States with the adoption of the 16th Amendment to the Constitution.

that the idea of taxes was made popular, and accepted by the majority, by telling the poor and the middle class that taxes were created only to punish the rich. This is how the masses voted for the law, and it became constitutionally legal. Although it was intended to punish the rich, in reality, it wound up punishing the very people who voted for it, the poor and middle class.

“Once the government got a taste of money, the appetite grew,”

It is the knowledge of the power of the legal structure of the corporation that really gives the rich a vast advantage over the poor and the middle class. Having two fathers teaching me, one a socialist and the other a capitalist, I quickly began to realize that the philosophy of the capitalist made more financial sense to me. It seemed to me that the socialists ultimately penalized themselves, due to their lack of financial education. No matter what the “Take from the rich” crowd came up with, the rich always found a way to outsmart them. That is how taxes were eventually levied on the middle class. The rich outsmarted the intellectuals, solely because they understood the power of money, a subject not taught in schools.

True capitalists used their financial knowledge to simply find a way to escape. They headed back to the protection of a corporation. A corporation protects the rich. But what many people who have never formed a corporation do not know is that a corporation is not really a thing. A corporation is merely a file folder with some legal documents in it, sitting in some attorney's office registered with a state government agency. It's not a big building with the name of the corporation on it. It's not a factory or a group of people. A corporation is merely a legal document that creates a legal body without a soul. The wealth of the rich was once again protected. Once again, the use of corporations became popular-once the permanent income laws were passed- because the income-tax rate of the corporation was less than the individual income-tax rates.

It was made possible because of the strong financial knowledge I had acquired through these lessons. Without this financial knowledge, which I call financial IQ, my road to financial independence would have been much more difficult. I now teach others through financial seminars in the hope that I may share my knowledge with them. Whenever I do my talks, I remind people that financial IQ is made up of knowledge from four broad areas of expertise.

No. 1 is accounting. What I call financial literacy. A vital skill if you want to build an empire. The more money you are responsible for, the more accuracy is required, or the house comes tumbling down. This is the left brain side, or the details. Financial literacy is the ability to read and understand financial statements. This ability allows you to identify the strengths and weaknesses of any business.

No. 2 is investing. What I call the science of money making money. This involves strategies and formulas. This is the right brain side or the creative side.

No. 3 is understanding markets. The science of supply and demand. There is a need to know the “technical” aspects of the market, which is emotion-driven; the Tickle Me Elmo doll during Christmas 1996 is a case of a technical or emotion-driven market. The other market factor is the “fundamental” or the economic sense of an investment. Does an investment make sense or does it not make sense based on the current market conditions.

No. 4 is the law. For instance, utilizing a corporation wrapped around the technical skills of accounting, investing, and markets can aid explosive growth. An individual with the knowledge of the tax advantages and protection provided by a corporation can get rich so much faster than someone who is an employee or a small-business sole proprietor. It's like the difference between someone walking and someone flying. The difference is profound when it comes to long-term wealth.

Financial IQ is actually the synergy of many skills and talents. But I would say it is the combination of the four technical skills listed above that make up basic financial intelligence. If you aspire to great wealth, it is the combination of these skills that will greatly amplify an individual's financial intelligence.

In 1874, England made income tax a permanent levy on its citizens. In 1913, an income tax became permanent in the United States with the adoption of the 16th Amendment to the Constitution.

In 1874, England made income tax a permanent levy on its citizens. In 1913, an income tax became permanent in the United States with the adoption of the 16th Amendment to the Constitution.Lesson Five: The Rich Invent Money

We all have tremendous potential, and we all are blessed with gifts

The land was wealth 300 years ago. So the person who owned the land owned the wealth. Then, it was factories and production, and America rose to dominance. The industrialist owned the wealth. Today, it is information. And the person who has the most timely information owns the wealth. The problem is, information flies all around the world at the speed of light. The new wealth cannot be contained by boundaries and borders as land and factories were. The changes will be faster and more dramatic. There will be a dramatic increase in the number of new multimillionaires. There also will be those who are left behind.

The land was wealth 300 years ago. So the person who owned the land owned the wealth. Then, it was factories and production, and America rose to dominance. The industrialist owned the wealth. Today, it is information. And the person who has the most timely information owns the wealth. The problem is, information flies all around the world at the speed of light. The new wealth cannot be contained by boundaries and borders as land and factories were. The changes will be faster and more dramatic. There will be a dramatic increase in the number of new multimillionaires. There also will be those who are left behind.

In 1984, I began teaching via games and simulations. I always encouraged adult students to look at games as reflecting back to what they know, and what they needed to learn. Most importantly, a game reflects back on one's behavior. It's an instant feedback system. Instead of the teacher lecturing you, the game is feeding back a personalized lecture, custom made just for you.

The game CASHFLOW was designed to give every player personal feedback. Its purpose is to give you options. If you draw the boat card and it puts you into debt, the question is, “Now what can you do?” How many different financial options can you come up with? That is the purpose of the game: to teach players to think and create new and various financial options.

There are a lot of people who have a lot of money and do not get ahead financially.

The land was wealth 300 years ago. So the person who owned the land owned the wealth. Then, it was factories and production, and America rose to dominance. The industrialist owned the wealth. Today, it is information. And the person who has the most timely information owns the wealth. The problem is, information flies all around the world at the speed of light. The new wealth cannot be contained by boundaries and borders as land and factories were. The changes will be faster and more dramatic. There will be a dramatic increase in the number of new multimillionaires. There also will be those who are left behind.

The land was wealth 300 years ago. So the person who owned the land owned the wealth. Then, it was factories and production, and America rose to dominance. The industrialist owned the wealth. Today, it is information. And the person who has the most timely information owns the wealth. The problem is, information flies all around the world at the speed of light. The new wealth cannot be contained by boundaries and borders as land and factories were. The changes will be faster and more dramatic. There will be a dramatic increase in the number of new multimillionaires. There also will be those who are left behind.Lesson Six: Work to Learn -Don't Work for Money

Rich dad explained to me that the hardest part of running a company is managing people. He had spent three years in the Army; my educated dad was draft-exempt. Rich dad told me of the value of learning to lead men into dangerous situations. “Leadership is what you need to learn next,” he said. “If you're not a good leader, you'll get shot in the back, just like they do in business.”

Rich dad explained to me that the hardest part of running a company is managing people. He had spent three years in the Army; my educated dad was draft-exempt. Rich dad told me of the value of learning to lead men into dangerous situations. “Leadership is what you need to learn next,” he said. “If you're not a good leader, you'll get shot in the back, just like they do in business.”

There is an old cliche that goes, “Job is an acronym for 'Just Over Broke.'” And unfortunately, I would say that the saying applies to millions of people. Because school does not think financial intelligence is intelligence, most workers “live within their means.” They work and they pay the bills

There is another horrible management theory that goes, “Workers work hard enough to not be fired, and owners pay just enough so that workers won't quit.” And if you look at the pay scales of most companies, again I would say there is a degree of truth in that statement

“Get a secure job.” Most workers focus on working for pay and benefits that reward them in the short term but are often disastrous in the long. Instead, I recommend to young people to seek work for what they will learn, more than what they will earn. Look down the road at what; skills they want to acquire before choosing a specific profession and before getting trapped in the “Rat Race.

Education is more valuable than money, in the long run.

The main management skills needed for success are:

1. The management of cash flow

2. The management of systems (including yourself and time with family)

3. The management of people.

The most important specialized skills are sales and understanding marketing. It is the ability to sell--therefore, to communicate to another human being, be it a customer, employee, boss, spouse or child-that is the base skill of personal success. It is communication skills such as writing, speaking and negotiating that are crucial to a life of success.

Overcoming Obstacles (Chapter Eight)

Once people have studied and become financially literate, they may still face roadblocks to becoming financially independent. There are five main reasons why financially literate people may still not develop abundant asset columns. Asset columns that could produce large sums of cash flow. Asset columns that could free them to live the life they dream of, instead of working full time just to pay bills. The five reasons are:

1. Fear.

2. Cynicism.

3. Laziness.

4. Bad habits.

5. Arrogance

Reason No. 1. Overcoming the fear of losing money. I have never met anyone who really likes losing money. And in all my years, I have never met a rich person who has never lost money.

The fear of losing money is real. Everyone has it. Even the rich. But it's not fear that is the problem. It's how you handle fear. It's how you handle losing. It's how you handle failure that makes the difference in one's life. That goes for anything in life, not just money. The primary difference between a rich person and a poor person is how they handle that fear

Quoting John D. Rockefeller, “I always tried to turn every disaster ' into an opportunity.”

Failure inspires winners. And failure defeats losers. It is the biggest secret of winners. It's the secret that losers do not know. The greatest secret of winners is that failure inspires winning; thus, they're not afraid of losing. Repeating Fran Tarkenton's quote, “Winning means being unafraid to lose.” People like Fran Tarkenton are not afraid of losing because they know who they are. They hate losing, so they know that losing will only inspire them to become better. There is a big difference between hating losing and being afraid to lose. Most people are so afraid of losing money that they lose

o. It's a great portfolio for someone who loves safely. But playing it safe and going “balanced” on your investment portfolio is not the way successful investors play the game. If you have little money and you want to be rich, you must first be “focused,” not “balanced.” If you look at anyone successful, at the start they were not balanced. Balanced people go nowhere. They stay in one spot. To make progress, you must first go unbalanced.

If you have any desire of being rich, you must focus. Put a lot of your eggs in a few baskets.

If you hate losing, play it safe. If losing makes you weak, play it safe. Go with balanced investments.

Reason No. 2. Overcoming cynicism “The sky is falling. The sky is falling.” Most of us know the story of “Chicken Little,” who ran around warning the barnyard of impending doom. We all know people who are that way. But we all have a “Chicken Little” inside each of us.

“What makes you think you can do that?” Or “If it's such a good idea, how come someone else hasn't done it?” Or “That will never work. You don't know what you're talking about.” These words of doubt often get so loud that we fail to act

“Cynics never win,” said rich dad. “Unchecked doubt and fear create I a cynic. Cynics criticize, and winners analyze” was another of his favorite sayings. Rich dad explained that criticism blinded while analysis opened -

'I don't wants' hold the key to your success

Reason No. 3. Laziness. Busy people are often the laziest.

So how do you beat laziness?

” A person needs to sit down and ask, “What's in it for me if I'm healthy, sexy and good looking?” Or “What would my life be like if I never had to work again?” Or “What would I do if I had all the money I needed?” Without that little greed, the desire to have something better, progress is not made. Our world progresses because we all desire a better life. New inventions are made because we desire something better.

” Be a little greedy. It's the best cure for laziness.

“Greed is good.” Rich dad said it differently: "Guilt is worse than greed.

Eleanor Roosevelt said it best: ”Do what you feel in your heart to be right-for you'll be criticized anyway. You'll be damned if you do, and damned if you don't."

Reason No. 4. Habits. Our lives are a reflection of our habits more than our education.

Reason No. 5. Arrogance. Arrogance is ego plus ignorance

“What I know makes me money. What I don't know loses me money. Every time I have been arrogant, I have lost money. Because when I'm arrogant, I truly believe that what I don't know is not important,”

When you know you are ignorant in a subject, start educating yourself by finding an expert in the field or find a book on the subject

Getting Started (Chapter Nine)

I offer you the following ten steps as a process to develop your God-given powers. Powers only you have control over

I offer you the following ten steps to awaken your financial genius. I simply offer you the steps I have personally followed. If you want to follow some of them, great. If you don't, make up your own. Your financial genius is smart enough to develop its own list

- I NEED A REASON GREATER THAN REALITY

- I CHOOSE DAILY

- CHOOSE FRIENDS CAREFULLY

- MASTER A FORMULA AND THEN LEARN A NEW ONE

- PAY YOURSELF FIRST

- PAY YOUR BROKERS WELL

- BE AN “INDIAN GIVER”

- ASSETS BUY LUXURIES

- THE NEED FOR HEROES

- TEACH AND YOU SHALL RECEIVE

1. I NEED A REASON GREATER THAN REALITY: If you ask most people if they would like to be rich or financially free, they would say “yes.” But then reality sets in. The road seems too long with too many hills to climb. It's easier to just work for money and hand the excess over to your broker.

A reason or purpose is a combination of “wants” and “don't want.” When people ask me what my reason for wanting to be rich is, it is a combination of deep emotional “wants” and “don't wants.”

I will list a few. First the “don't want,” for they create the “wants.” I don't want to work all my life. I don't want what my parents aspired for, which was job security and a house in the suburbs. I don't like being an employee. I hated that my dad always missed my football games because he was so busy working on his career. I hated it when my dad worked hard all his life and the government took most of what he worked for at his death. He could not even pass on what he worked so hard for when he died. The rich don't do that. They work hard and pass it on to their children.

2. I CHOOSE DAILY

The power of choice. That is the main reason people want to live in a free country. We want the power to choose

Financially, with every dollar we get in our hands, we hold the power to choose our future to be rich, poor, or middle class. Our spending habits reflect who we are. Poor people simply have poor spending habits.

Most people choose not to be rich

two things: one is time, which is your most precious asset, and two is learning

Just because you have no money, should not be an excuse to not learn. But that is a choice we all make daily, the choice of what we do with our time, our money and what we put in our heads. That is the power of choice. All of us have a choice. I just choose to be rich, and I make that choice every day.

3. CHOOSE FRIENDS CAREFULLY:

The power of association. First of all, I do not choose my friends by their financial statements. I have friends who have actually taken the vow of poverty as well as friends who earn millions every year. The point is I learn from all of them, and I consciously make the effort to learn from them.

I've noticed that my friends with money talk about money. And I do not mean brag. They're interested in the subject. So I learn from them, and they learn from me.

4. MASTER A FORMULA AND THEN LEARN A NEW ONE:

In order to make bread, every baker follows a recipe, even if it's only held in their head. The same is true for making money. That's why money is often called “dough.”

\

When it comes to money, the masses generally have one basic formula they learned in school. And that is, work for money. The formula I see that is predominant in the world is that every day millions of people get up and go to work, earn money, pay bills, balance checkbooks, buy some mutual funds and go back to work. That is the basic formula or recipe.

I spent my spare time learning to master the art of buying foreclosures. I've made several million dollars using that formula, but today, it's too slow, and too many other people are doing it.

but I always learned something new.

5. PAY YOURSELF FIRST: The power of self-discipline.

If you cannot get control of yourself, do not try to get rich. You might first want to join the Marine Corps or some religious order so you can get control of yourself. It makes no sense to invest, make money, and blow it. It is the lack of self-discipline that causes most lottery winners to go broke soon after winning millions. It is the lack of self-discipline that causes people who get a raise to immediately go out and buy a new car or take a cruise.

I would venture to say that it is the lack of personal self-discipline that is the No. 1 delineating factor between the rich, the poor and the middle class

The three most important management skills necessary to start your own business are:

1. Management of cash flow.

2. Management of people.

3. Management of personal time.

6. PAY YOUR BROKERS WELL:

The power of good advice. I often see people posting a sign in front of their house that says, “For Sale by Owner.” Or I see on TV today many people claiming to be “Discount Brokers.”

He believed in paying professionals well,

Today, I have expensive attorneys, accountants, real estate brokers, and stockbrokers. Why? Because if, and I do mean if, the people are professionals, their services should make you money. And the more money they make, the more money I make.

7. BE AN “INDIAN GIVER”:

This is the power of getting something for nothing. When the first white settlers came to America, they were taken aback by a cultural practice some American Indians had. For example, if a settler was cold, the Indian would give the person a blanket. Mistaking it for a gift, the settler was often offended when the Indian asked for it back.

The Indians also got upset when they realized the settlers did not want to give it back. That is where the term “Indian giver” came from. A simple cultural misunderstanding.

In the world of the “asset column,” being an Indian giver is vital to wealth. The sophisticated investor's first question is, “How fast do I get my money back?” They also want to know what they get for free, also called a piece of the action. That is why the ROI, or return of and on investment, is so important.

8. ASSETS BUY LUXURIES: The power of focus.

we focus on borrowing money to get the things we want instead of focusing on creating money. One is easier in the short term, but harder in the long term. It's a bad habit that we as individuals and as a nation have gotten into. Remember, the easy road often becomes hard, and the hard road often becomes easy.

The earlier you can train yourself and those you love to be masters of money, the better. Money is a powerful force. Unfortunately, people use the power of money against them. If your financial intelligence is low, the money will run all over you. It will be smarter than you. If money is smarter than you, you will work for it all your life.

9. THE NEED FOR HEROES:

The power of myth

By having heroes, we tap into a tremendous source of raw genius.

But heroes do more than simply inspire us. Heroes make things look easy. It's making it look easy that convinces us to want to be just like them. “If they can do it, so can I.”

10. TEACH AND YOU SHALL RECEIVE: The power of giving. Both of my dads were teachers. My rich dad taught me a lesson I have carried all my life, and that was the necessity of being charitable or giving. My educated dad gave a lot by the way of time and knowledge, but almost never gave away money. As I said, he usually said that he would give when he had some extra money. Of course, there was rarely any extra

My rich dad gave money as well as education. He believed firmly in tithing. “If you want something, you first need to give,” he would always say. When he was short of money, he simply gave money to his church or to his favorite charity.

” And when it comes to money, love, happiness, sales, and contacts, all one needs to remember is first to give what you want and it will come back in droves.

Still, Want More? Here are Some To Do's (Chapter Ten)

Stop doing what you're doing. In other words, take a break and assess what is working and what is not working. The definition of insanity is doing the same thing and expecting a different result. Stop doing what is not working and look for something new to do.

TAKE ACTION!

Many of you were given two great gifts: your mind and your time. It is up to you to do what you please with both. With each dollar bill that enters your hand, you and only you have the power to determine your destiny. Spend it foolishly, you choose to be poor. Spend it on liabilities, you join the middle class. Invest it in your mind and learn how to acquire assets and you will be choosing wealth as your goal and your future. The choice is yours and only yours. Every day with every dollar, you decide to be rich, poor or middle class.

Choose to share this knowledge with your children, and you choose to prepare them for the world that awaits. No one else will.

You and your children's future will be determined by the choices you make today, not tomorrow.

We wish you great wealth and much happiness with this fabulous gift called life.

Rich Dad Poor Dad

Robert Kiyosaki, Sharon Lechter

About the Authors-Robert T. Kiyosaki

“The main reason people struggle financially is that they spent years in school but learned nothing about money. The result is, people, learn to work for money... but never learn to have money work for them,” says Robert.

Born and raised in Hawaii, Robert is a fourth-generation Japanese American. He comes from a prominent family of educators. His father was the head of education for the State of Hawaii. "After high school, Robert was educated in New York and upon graduation, he joined the U. S. Marine Corps and went to Vietnam as an officer and a helicopter gunship pilot.

Returning from the war, Robert's business career began. In 1977 he founded a company that brought to the market the first nylon and Velcro “surfer” wallets, which grew into a multi-million dollar worldwide product. He and his products were featured in Runner's World, Gentleman's Quarterly, Success Magazine, Newsweek, and even Playboy.

Leaving the business world, he co-founded in 1985, an international education company that operated in seven countries, teaching business and investing to tens of thousands of graduates.

Retiring at age 47, Robert does what he enjoys most... investing. Concerned about the growing gap between the haves and have nots, Robert created the board game CASHFLOW, which teaches the game of money, here before only known by the rich

Although Robert's business is a real estate and developing small-cap companies, his true love and passion are teaching. He has shared the speaking stage with such greats as Og Mandino, Zig Ziglar, and Anthony Robbins. Robert Kiyosaki's message is clear. “Take responsibility for your finances or take orders all your life. You're either a master of money or a slave to it.” Robert holds classes that last from 1 hour to 3 days teaching people about the secrets of the rich. Although his subjects run from investing for high returns and low risk; to teaching your children to be rich; to starting companies and selling them; he has one solid earth-shaking message. And that message is, Awaken The Financial Genius that lies within you. Your genius is waiting to come out.

This is what world-famous speaker and author Anthony Robbins says about Robert's work

“Robert Kiyosaki's work in education is powerful, profound, and life-changing. I salute his efforts and recommend him highly.” During this time of great economic change, Robert's message is priceless.

About the Authors-Sharon L. Lechter Wife and mother of three, CPA, consultant to the toy and publishing industries and business owner, Sharon Lechter has dedicated her professional efforts to the field of education.

She graduated with honors from Florida State University with a degree in accounting. She joined the ranks of what was then one of the big eight accounting firms and went on to become the CFO of a turnaround company in the computer industry, tax director for a national insurance company and founder and Associate Publisher of the first regional woman's magazine in Wisconsin, all while maintaining her professional credentials as a CPA.

Her focus quickly changed to education as she watched her own three children grow. It was a struggle to get them to read. They would rather watch TV.

So she was delighted to join forces with the inventor of the first electronic “talking book” and help expand the electronic book industry to a multi-million dollar international market. Today, she remains a pioneer in developing new technologies to bring the book back into children's lives.

“Our current educational system has not been able to keep pace with the global and technological changes in the world today. We must teach our young people the skills, both scholastic and financial, that they will need not only to survive, but to flourish, in the world they face.”

As co-author of Rich Dad Poor Dad and the CASHFLOW Quadrant, she now focuses her efforts in helping to create educational tools for anyone interested in bettering their own financial education

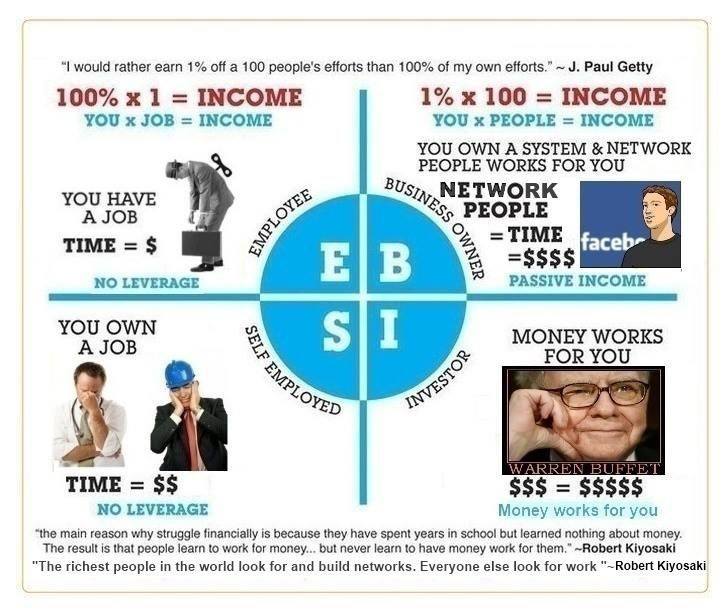

Self-employment – you have to put your time to make money, but from assets without putting your time to make money.

I offer you the following ten steps as a process to develop your God-given powers. Powers only you have control over

Returning from the war, Robert's business career began. In 1977 he founded a company that brought to the market the first nylon and Velcro “surfer” wallets, which grew into a multi-million dollar worldwide product. He and his products were featured in Runner's World, Gentleman's Quarterly, Success Magazine, Newsweek, and even Playboy.

Leaving the business world, he co-founded in 1985, an international education company that operated in seven countries, teaching business and investing to tens of thousands of graduates.

Retiring at age 47, Robert does what he enjoys most... investing. Concerned about the growing gap between the haves and have nots, Robert created the board game CASHFLOW, which teaches the game of money, here before only known by the rich

Although Robert's business is a real estate and developing small-cap companies, his true love and passion are teaching. He has shared the speaking stage with such greats as Og Mandino, Zig Ziglar, and Anthony Robbins. Robert Kiyosaki's message is clear. “Take responsibility for your finances or take orders all your life. You're either a master of money or a slave to it.” Robert holds classes that last from 1 hour to 3 days teaching people about the secrets of the rich. Although his subjects run from investing for high returns and low risk; to teaching your children to be rich; to starting companies and selling them; he has one solid earth-shaking message. And that message is, Awaken The Financial Genius that lies within you. Your genius is waiting to come out.

This is what world-famous speaker and author Anthony Robbins says about Robert's work

“Robert Kiyosaki's work in education is powerful, profound, and life-changing. I salute his efforts and recommend him highly.” During this time of great economic change, Robert's message is priceless.

About the Authors-Sharon L. Lechter Wife and mother of three, CPA, consultant to the toy and publishing industries and business owner, Sharon Lechter has dedicated her professional efforts to the field of education.

Her focus quickly changed to education as she watched her own three children grow. It was a struggle to get them to read. They would rather watch TV.

As co-author of Rich Dad Poor Dad and the CASHFLOW Quadrant, she now focuses her efforts in helping to create educational tools for anyone interested in bettering their own financial education

.jpg)

No comments:

Post a Comment